vermont income tax withholding

During the American Civil War and Reconstruction Era when both the United States of. A reproduction of the 2019 annual percentage method withholding tables begins on.

If the Federal exemptions are used and the employee has elected to have additional Federal taxes withheld then additional State withholdings will be withheld at 27 percent of the additional.

. The 1850s brought another few income tax abolitions. On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes. W-2 and 1099 may be.

The Vermont Department of Taxes released its 2019 state income tax withholding tables and guide. All persons having the control receipt custody disposal or payment of certain items of that income are withholding agents and are required to deduct and withhold from. When you start a new job your employer will ask you to complete a federal Form W-4 the Employees Withholding Allowance Certificate and a Form W-4VT for Vermont withholding.

Exemption Allowance 4500 x. State government websites often end in gov or mil. You must pay estimated income tax if you are self employed or do not pay.

The following revisions have been made from the previous. The annual amount per allowance has changed from 4350 to 4400. The annual amount per allowance has changed from 4400 to 4500.

Maryland and Vermont in 1850 and Florida in 1855. If Federal exemptions were used and there are additional Federal withholdings proceed to step. The Vermont Department of Taxes issued guidance concerning the income tax and income tax withholding requirements that apply to wages paid for services provided temporarily in the.

Census Bureau Number of cities with local income taxes. March 8 2019 Effective. If you want even more control over your.

Vermont income tax rate. TAXES 19-23 Vermont State Income Tax Withholding. The Vermont Income Tax Withholding is computed in the same manner as federal withholding tax by using the Vermont withholding tables or wage bracket charts.

Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. Once the employer has the information youve entered on forms W-4 and W-4VT the employer is able to calculate your withholding tax. Pay Period 03 2019.

The Vermont Land Gains Tax is a flat tax rather than a marginal tax like the income tax. Up to 25 cash back Here are the basic rules on Vermont state income tax withholding for employees. The income tax withholding formula on.

Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute taxable income. To help employers calculate. Amount of Vermont income tax withholding reported during the year to the amount of withholding tax shown on the W-2 andor 1099 forms.

The gov means its official. Provided the state does not have any outstanding Title XII. The filing status number.

With rare exceptions if your small business has employees working in. The income tax withholding for the State of Vermont includes the following changes. The 2022 rates range from 08 to 65 on the first.

An Official Vermont Government Website. Before sharing sensitive information make sure. The Vermont Department of Taxes has published its 2019 Income Tax Withholding Instructions Tables and Charts.

That means the highest applicable tax applies to the entire gain. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. As an employer in Vermont you have to pay unemployment insurance to the state.

Form WHT-434 and Forms. The income tax withholding for the State of Vermont includes the following changes. Vermont State Unemployment Insurance.

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Missouri Income Tax Rate And Brackets H R Block

State Income Tax Extensions Weaver Assurance Tax Advisory Firm

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

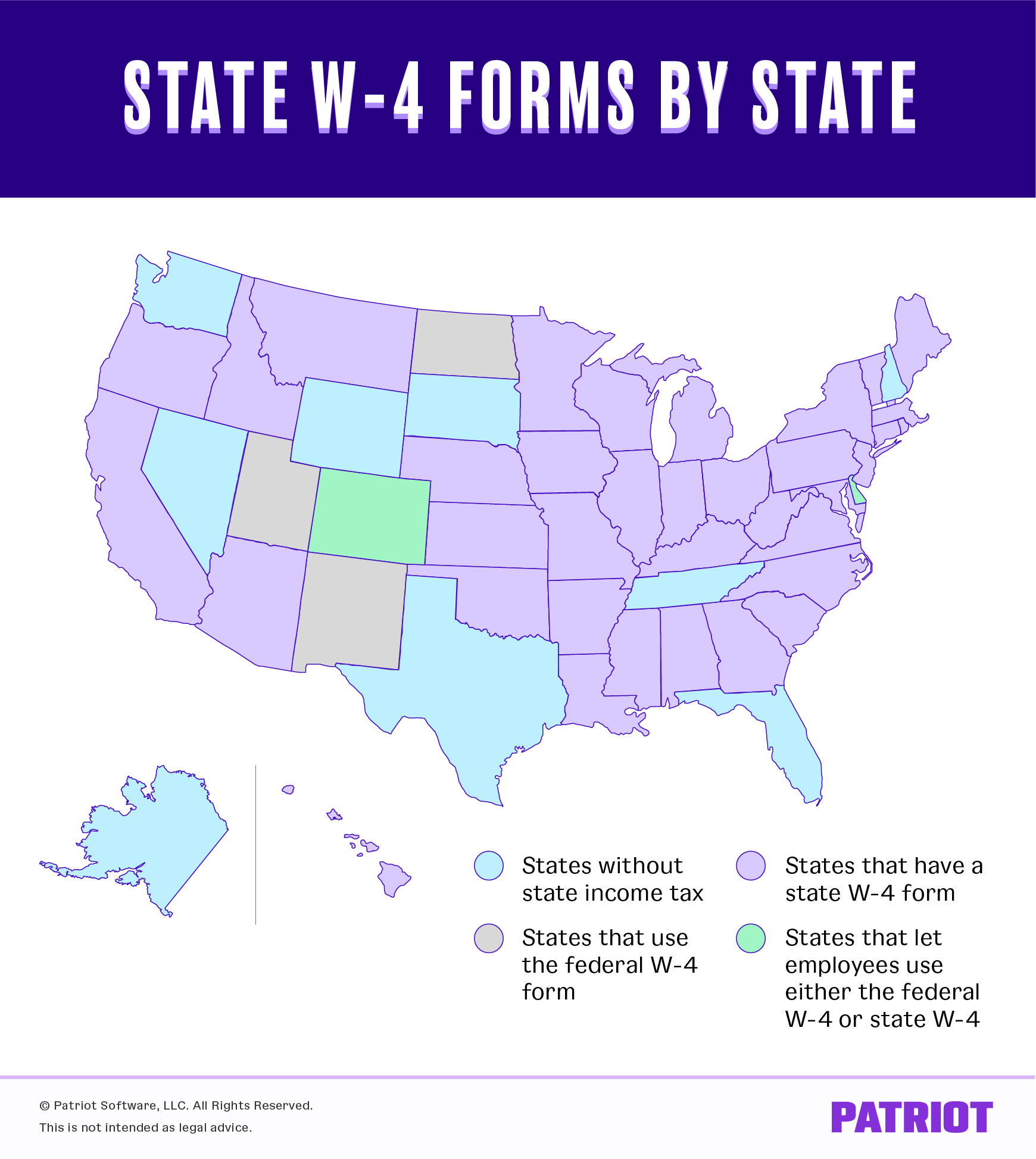

State W 4 Form Detailed Withholding Forms By State Chart

State Income Tax Rates Highest Lowest 2021 Changes

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Paycheck Taxes Federal State Local Withholding H R Block

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

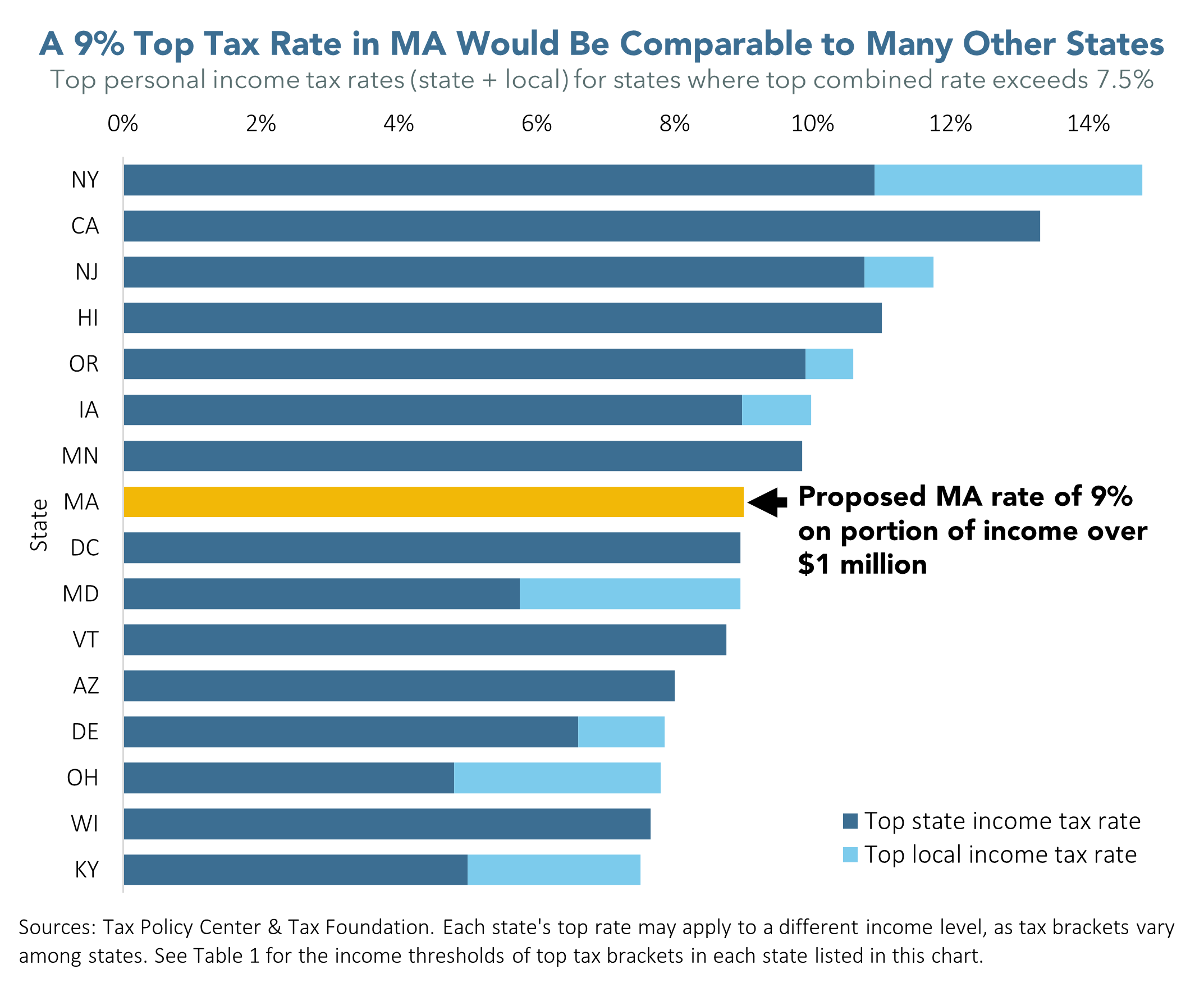

With Millionaire Tax Massachusetts Top Tax Rate Would Compare Well To Top Rates In Other States Mass Budget And Policy Center

Irs Form 945 How To Fill Out Irs Form 945 Gusto

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

State W 4 Form Detailed Withholding Forms By State Chart

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)